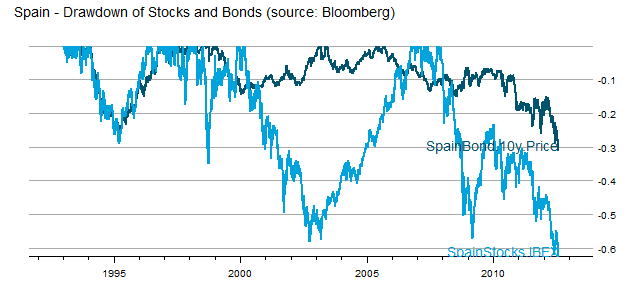

US investors were spoiled by US Treasuries which acted as a near perfect hedge to stocks during the 2008-2009 crisis. However, in real crisis, bonds rarely offer any comfort, and asset allocation fails (see post Death Spiral of a Country and IMF paper Systemic Banking Crises Database: An Update; by Luc Laeven ... – IMF). As a very timely example, we can examine Spain, which is not even to crisis level yet.

|

| From TimelyPortfolio |

In Spain, there is nowhere to hide, and allocation offers no comfort.

Surely you could build a system based on the principle of "nowhere to hide" like

ReplyDeleteIF gold(LOCALCURRENCY) < 10MA THEN

switch 60% to bonds

switch 40% to stocks

IF stocks/LOCALCURRENCY < 10MA THEN

switch 60% to X

IF bonds < 10MA THEN

switch 40% to X

WHERE

IF gold(LOCALCURRENCY) < 10MA

X IS 3-month LOCALCURRENCY

IF gold(LOCALCURRENCY > 10MA

X IS gold

Wow that came out a lot more jumbled up than I intended, hope you get the idea.

ReplyDelete