Although I am sure most of the bloggers that discuss R on R-bloggers are not all that concerned with popularity, I thought it would be interesting to analyze (with R and rCharts, of course) the popularity of these bloggers using Feedly’s API.

After building the chart, I got to thinking about these two excellent posts about the nature of blog popularity.

How many more R-bloggers posts can I expect? by Markus Gesmann

Blog posts' half life - why bother? by Bruce McPherson

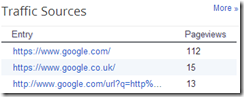

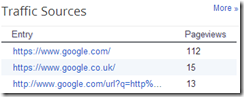

Clearly not posting for a month (me) is not the way to fame and glory as Google search becomes the most common referrer.

Also, is Bruce McPherson onto something when he points out that the nature of a blog does not lend to permanence? Should every blog, especially educational ones, also have a different view of the same content that lends itself better to permanence?

For those that missed me, I’m back.

R code to get Feedly API data and build dimplejs chart: Github repo