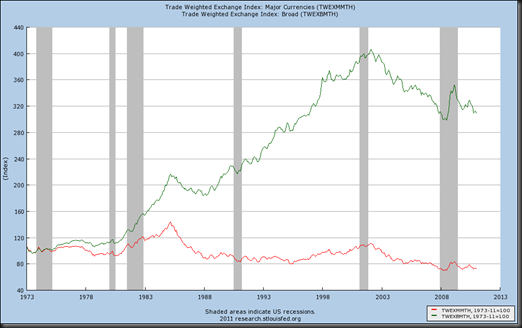

Bernanke is not finished with his devaluation job until significant additional deterioration in USD on a broad basis. With low rates and continued stability in the dollar, I can see how he can justify pursuing the bad monetary policies enabled by emerging market currency undervaluation and dollar reserves.

As I am assembling data on the country death spiral of lower domestic stock prices, higher bond rates, and >50% currency devaluation, I wonder how the dollar will survive an attack against itself or any other currency, since the first reaction of another currency attack will be to sell dollars in defense.

No comments:

Post a Comment