via StockCharts.com

I am struggling with what this means, and how I might benefit from the changed relationship. I have imagined some of the reasons, but I’m still missing something. So far, my list:

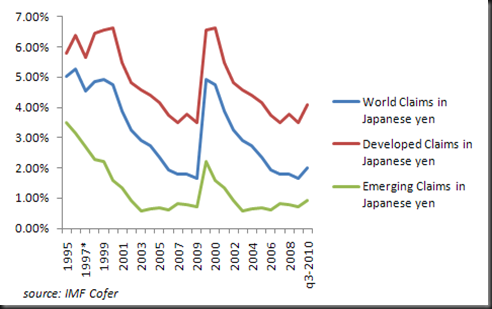

1) Emerging market countries have diversified their reserves and bought more Japanese Yen, but this does not show up on IMF Reserves.

2) Yen and Treasuries are both now viewed as “safe” and “riskless”, so they are pursued as insurance similar to gold. However, these only work simultaneously in a deflationary environment. If inflation appears (I think it is here), but others clearly disagree, does the Yen get hurt with US Treasuries?

The credit default market clearly does not consider the Yen as riskless since Japan carries a higher default probability on its sovereign debt.

3) Momentum investors are buying the Japanese Yen as the best performing reserve currency simply following a trend model. However in the multi-trillion currency market, I do not think this influence would be strong enough to force this imbalance.

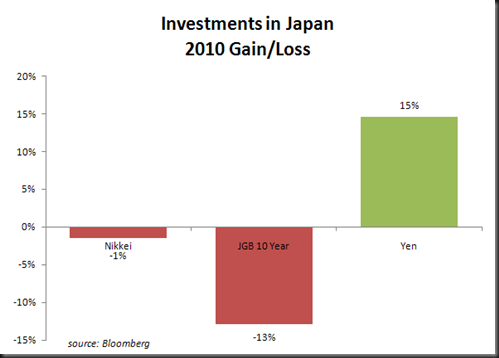

4) Maybe the Japanese Yen is the only thing in Japan that actually goes up, so the Japanese Yen is the place in Japan to make money.

It appears that these reasons do not offer adequate explanation for the continued Yen rise, so I need to do more work and be a little more creative figuring this out. Please let me know if you have any good explanations.

After this thought exercise, I still believe that the situation is tenuous and certainly cannot find any good reasons to own the Japanese Yen.

2.5 hours

No comments:

Post a Comment