The PIMCO All Asset funds are managed by Research Affiliates Robert Arnott and invest only in other PIMCO mutual funds rather than individual securities, so in many ways the fund’s success is dependent on the quality and breadth of other PIMCO funds. Since it sounds slightly incestuous, I thought it would be a good subject for my new tools—sankey diagrams and basic network analysis.

Excel to Edgelist with Old-school VBA

Since PIMCO (and nobody else for that matter) doesn’t provide holdings in an igraph readable edgelist, I decided to revive some fond memories and use VBA to convert the spreadsheet into a 3 column edgelist (source, target, value). Even though I am embarrassed by my VBA code, I will show it below.

Sub getedgelist()

Dim clInfo As Range, clWrite As Range, tempcl As Range

Dim offsetamt As Integer

'this will be used throughout to indicate columns to offset for desired date

'watch out for hidden rows

offsetamt = 15

'clInfo will be the cell with our reference information

Set clInfo = ThisWorkbook.ActiveSheet.Range("a9")

'clWrite will be the cell where we write the info that we gather

Set clWrite = ThisWorkbook.ActiveSheet.Range("u9")

Do Until clInfo = "Total Gross Asset Allocation"

'looking at formatting is probably the easiest way to determine if group or fund

'I chose indent to determine if group or fund

'IndentLevel = 0 for groups and 1 for funds

If clInfo.IndentLevel = 0 Then

'if we are on a group write in clWrite the group and each fund within the group

'with group as source and fund as target

'we will loop until we are at the next group

Set tempcl = clInfo

'write mutual fund as source, group as target, and weight

clWrite.Value = ThisWorkbook.ActiveSheet.Range("e6").Value

clWrite.Offset(0, 1).Value = clInfo.Value

clWrite.Offset(0, 2).Value = clInfo.Offset(0, offsetamt).Value

Set clWrite = clWrite.Offset(1, 0)

Do Until tempcl.Offset(1, 0).IndentLevel = 0

'now loop through each fund in group

'write group as source, held fund as target, and weight

clWrite.Value = clInfo.Value

clWrite.Offset(0, 1).Value = tempcl.Offset(1, 0).Value

clWrite.Offset(0, 2).Value = tempcl.Offset(1, offsetamt).Value

'next cell down

Set tempcl = tempcl.Offset(1, 0)

Set clWrite = clWrite.Offset(1, 0)

Loop

Set clInfo = clInfo.Offset(1, 0)

Else

End If

'if we are on a group write in clWrite the group and each fund within the group

'with group as source and fund as target

Debug.Print (clInfo)

Set clInfo = clInfo.Offset(1, 0)

Loop

End SubNow we have everything we need to do the sankey diagram in R.

#sankey of PIMCO All Asset All Authority holdings

#data source http://investments.pimco.com/ShareholderCommunications/External%20Documents/PIMCO%20Bond%20Stats.xls

require(rCharts)

#originally read the data from clipboard of Excel copy

#for those interested here is how to do it

#read.delim(file = "clipboard")

holdings = read.delim("http://timelyportfolio.github.io/rCharts_d3_sankey/holdings.txt", skip = 3, header = FALSE, stringsAsFactors = FALSE)

colnames(holdings) <- c("source","target","value")

#get rid of holdings with 0 weight or since copy/paste from Excel -

holdings <- holdings[-which(holdings$value == "-"),]

holdings$value <- as.numeric(holdings$value)

#now we finally have the data in the form we need

sankeyPlot <- rCharts$new()

sankeyPlot$setLib('http://timelyportfolio.github.io/rCharts_d3_sankey')

sankeyPlot$set(

data = holdings,

nodeWidth = 15,

nodePadding = 10,

layout = 32,

width = 750,

height = 500,

labelFormat = ".1%"

)

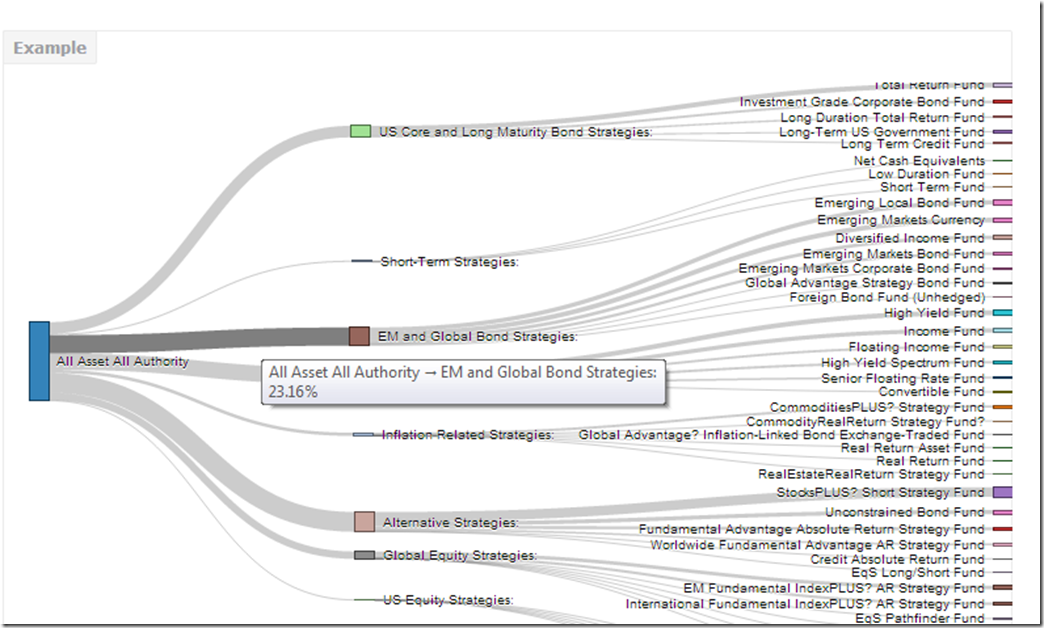

sankeyPlotBlogger makes it hard to incorporate d3 directly into this post, so click here or on the screenshot below, to engage and interact with the sankey.

Just for good measure, here is the default plot from igraph.

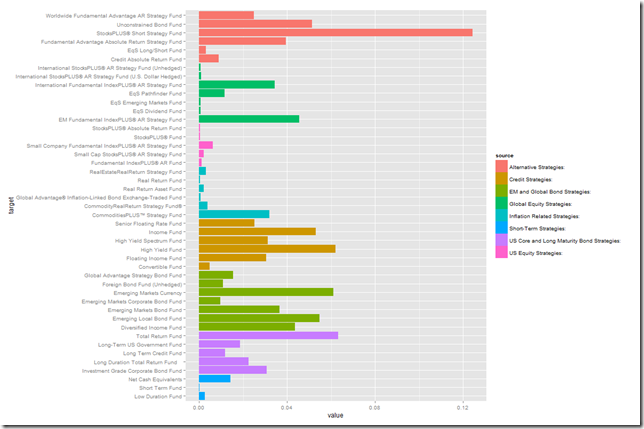

Of course we could also plot the data a little more traditionally with a ggplot2 bar chart.

Any way we look at it, we can see that PIMCO now has way more than just bonds and the fund All Asset All Authority uses almost everything.

Very nice post!

ReplyDeleteHi, this was a great and very informative post. I do have one question: I am probably missing something very obvious, but where does one get the file "chart.html" that you reference in this line of code?

ReplyDeletesankeyPlot$setTemplate(script = "layouts/chart.html")

thanks, honored that you liked

ReplyDeleteActually, rCharts has made this even easier now. Install the newest dev branch:

ReplyDeleteinstall_github('rCharts', 'ramnathv', ref = "dev")

Then use the code you see in http://rcharts.io/viewer/?6022406. Let me know if this does not work.

Thanks! That totally worked. Very helpful

ReplyDeleteThank you for the great demo! It has been really helpful. I'm an R user with no experience with D3. My question is: is there a way to make the bands different colors? I'm thinking along the lines of:

ReplyDeletehttp://hangingtogether.org/?p=3053

Thanks again for the help and I look forward to hearing from you.