#thanks so much to the developers of quantstrat

#99% of this code comes from the demos in the quantstrat package #in this I use osFun to size orders to ending equity

#for a more appropriate comparison to buy hold #takes longer than I would like but is acceptable

#another way to accomplish testing and reporting

#is use 1 for orderqty and then generate return series

#with this as signal #however despite extra time I like to see growth in order size

#with performance

#makes a very valid point for drawdown reduction require(quantstrat)

require(PerformanceAnalytics) #now let's define our silly countupdown function

CUD <- function(price,n) {

#CUD takes the n-period sum of 1 (up days) and -1 (down days)

temp <- runSum(ifelse(ROC(price,1,type="discrete") > 0,1,-1),n)

colnames(temp) <- "CUD"

temp

} BuyHold <- function(price,periodtobuy) {

#just enter true (1) the period specified as buy and hold

#for the remainder

temp <- as.xts(rep(0,NROW(price)),order.by=index(price))

colnames(temp) <- "BuyHold"

temp[periodtobuy,1]<-1

temp

} osFillErUp <- function (data, timestamp, orderqty, ordertype, orderside, portfolio, symbol, ruletype, ..., orderprice)

{ #get date in usable xts format

datePos <- format(timestamp,"%Y-%m-%d")

#update the portfolio to date of trade rule

updatePortf(Portfolio=portfolio,Symbol=symbol,Dates=paste('::',datePos,sep=''))

portf <- getPortfolio(portfolio)

#get price of symbol for the date of trade rule

price <- getPrice(get(symbol))[datePos]

#get amount generated from the last trade

#best way for me to overcome lack of cumulative p/l for portfolio by symbol

#all this logic is at the account level

trades <- getOrderBook(portfolio)[[portfolio]][[symbol]]

#if first trade, just use order quantity specified

#if not get order quantity equal to

#last trade proceeds divided by price of symbol at trade date

if(NROW(trades)>1) {

trades <- trades[NROW(trades)]

endEq <- as.numeric(trades$Order.Qty) * as.numeric(trades$Order.Price)

# orderqty <- abs(endEq/price)

orderqty <- abs(floor(endEq/price))

}

#return the new orderqty

osFillErUp <- orderqty

} try(rm("order_book.CUD",pos=.strategy),silent=TRUE)

try(rm("order_book.BuyHold",pos=.strategy),silent=TRUE)

try(rm("account.CUD","portfolio.CUD",pos=.blotter),silent=TRUE)

try(rm("account.BuyHold","portfolio.BuyHold",pos=.blotter),silent=TRUE)

try(rm("port.st","symbols","symbol","stratCUD","initDate","initEq",

'start_t','end_t','num_periods'),silent=TRUE) #specify this for the rolling periods to use for our signal

num_periods=50 # Initialize a strategy object

stratCUD <- strategy("CUD") # Add an indicator

stratCUD <- add.indicator(strategy = stratCUD, name = "CUD",

arguments = list(price = quote(Cl(mktdata)),n=num_periods),

label="CUD") # enter when CUD > 0

stratCUD <- add.signal(strategy = stratCUD, name="sigThreshold",

arguments = list(threshold=0, column="CUD",relationship="gte", cross=TRUE),

label="CUD.gte.0")

# exit when CUD < 0

stratCUD <- add.signal(strategy = stratCUD, name="sigThreshold",

arguments = list(threshold=0, column="CUD",relationship="lt",cross=TRUE),

label="CUD.lt.0") stratCUD <- add.rule(strategy = stratCUD, name='ruleSignal',

arguments = list(sigcol="CUD.gte.0", sigval=TRUE, orderqty=100, ordertype='market',

orderside='long', pricemethod='market', replace=FALSE, osFUN='osFillErUp'), type='enter', path.dep=TRUE)

stratCUD <- add.rule(strategy = stratCUD, name='ruleSignal',

arguments = list(sigcol="CUD.lt.0", sigval=TRUE, orderqty='all',

ordertype='market', orderside='long', pricemethod='market', replace=FALSE),

type='exit', path.dep=TRUE) #Initialize a buy/hold strategy object

stratBuyHold <- strategy("BuyHold")

stratBuyHold <- add.indicator(strategy = stratBuyHold, name = "BuyHold",

arguments = list(price = quote(Cl(mktdata)),periodtobuy=num_periods),

label = "BuyHold")

stratBuyHold <- add.rule(strategy=stratBuyHold, name='ruleSignal',

arguments = list(sigcol="BuyHold",sigval=TRUE,orderqty=100,ordertype='market',

orderside='long', pricemethod='market', replace=FALSE), type='enter', path.dep=TRUE) currency("USD")

symbols = c("GSPC","GDAXI")

for (symbol in symbols) {

stock(symbol, currency="USD",multiplier=1)

#use paste with ^ to get index data

getSymbols(paste("^",symbol,sep=""),adjust=T,from="1900-12-31")

assign(symbol,to.weekly(get(symbol)))

} initDate='1949-12-31'

initEq=1000000

port.st<-'CUD' #use a string here for easier changing of parameters and re-trying

port.buyhold <- 'BuyHold' initPortf(port.st, symbols=symbols, initDate=initDate)

initAcct(port.st, portfolios=port.st, initDate=initDate, initEq=initEq)

initOrders(portfolio=port.st, initDate=initDate) initPortf(port.buyhold, symbols=symbols, initDate=initDate)

initAcct(port.buyhold, portfolios=port.buyhold, initDate=initDate,, initEq=initEq)

initOrders(portfolio=port.buyhold, initDate=initDate) print("setup completed") # Process the indicators and generate trades

start_t<-Sys.time()

out<-try(applyStrategy(strategy=stratCUD , portfolios=port.st ) )

end_t<-Sys.time()

print("Strategy Loop:")

print(end_t-start_t) # Process buy and hold strategy

start_t<-Sys.time()

out<-try(applyStrategy(strategy=stratBuyHold , portfolios=port.buyhold ) )

end_t<-Sys.time()

print("Strategy Loop:")

print(end_t-start_t) start_t<-Sys.time()

updatePortf(Portfolio=port.st,Dates=paste('::',as.Date(Sys.time()),sep=''))

updatePortf(Portfolio=port.buyhold,Dates=paste('::',as.Date(Sys.time()),sep=''))

end_t<-Sys.time()

print("trade blotter portfolio update:")

print(end_t-start_t) # hack for new quantmod graphics, remove later

themelist<-chart_theme()

themelist$col$up.col<-'lightgreen'

themelist$col$dn.col<-'pink' for(symbol in symbols){

#dev.new()

#chart.Posn(Portfolio=port.st,Symbol=symbol,theme=themelist)

#add the CUD indicator to the bottom of the chart

#jpeg(filename=paste(symbol," Reconcile.jpg",sep=""),quality=100,

# width=6.5, height = 6.5, units="in",res=96)

chart.Reconcile(port.buyhold,port.st,symbol)

plot(add_TA(CUD(get(symbol)[,4],n=num_periods)))

#dev.off()

} #tradeStats(port.st) #backwards way to get returns

#again to bypass account p/l logic

port <- getPortfolio(port.st)

for(symbol in symbols) {

#get posPL for the symbol in the portfolio

posPLTable <- port$symbols[[symbol]][["posPL"]]

#easier this way to get ROC for each day when position is held (Pos.Qty > 0)

#rets <- lag(ifelse(posPLTable$Pos.Qty>0,1,0),k=1)*ROC(get(symbol)[,4],type="discrete",n=1)

#the previous commented method is not exactly correct

#since we can only hold integer positions

#to account for this difference we can get

rets <- posPLTable$Gross.Trading.PL/lag(posPLTable$Pos.Value,k=1)

rets[is.na(rets)] <- 0

rets[which(rets[,1]==Inf)] <- 0

rets[which(rets[,1]==-Inf)] <- 0

retCompare <- merge(rets,ROC(get(symbol)[,4],type="discrete",n=1))

colnames(retCompare) <- c(paste(symbol," CUD System",sep=""),symbol)

#jpeg(filename=paste(symbol," Performance.jpeg",sep=""),quality=100,width=6.5, height = 6.5,

# units="in",res=96)

charts.PerformanceSummary(retCompare,ylog=TRUE,

colorset=c("black","gray70"),

main = paste(symbol," CUD System and Index

Performance Summary",sep=""))

#dev.off()

#jpeg(filename=paste(symbol," Capture.jpeg",sep=""),quality=100,width=6.5, height = 6.5,

# units="in",res=96)

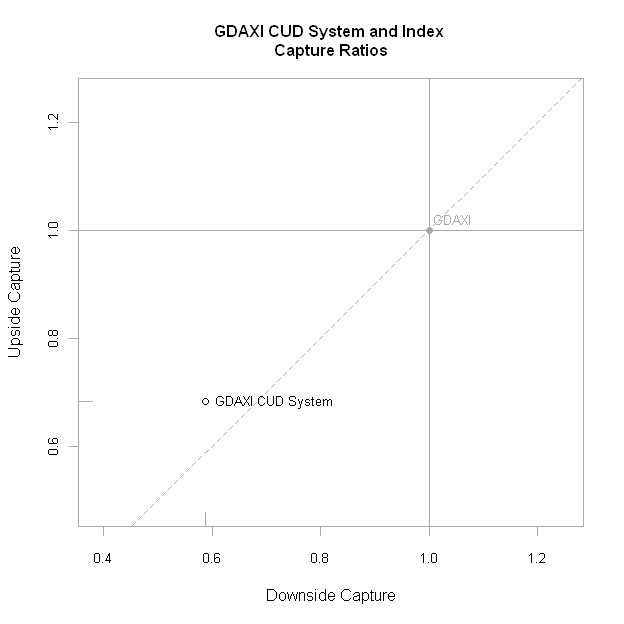

chart.CaptureRatios(retCompare[,1],retCompare[,2],

main = paste(symbol," CUD System and Index

Capture Ratios",sep=""))

#dev.off()

}

Another very nice example...

ReplyDeleteosFillErUp only works for long trades?

Cordially,

-DD-