require(quantmod)

require(PerformanceAnalytics) getSymbols("SP500",src="FRED")

getSymbols("DGS10",src="FRED")

getSymbols("DTWEXB",src="FRED")

getSymbols("DTWEXM",src="FRED") fedData <- na.omit(merge(SP500,DGS10,DTWEXB))

fedData <- merge(ROC(fedData[,1],type="discrete",n=1),

ROC(fedData[,2]/fedData[,3],type="discrete",n=1))

colnames(fedData) <- c("SP500","US10y/USDBroad") #jpeg(filename="performance since 2007.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

chart.CumReturns(fedData["2007::"],legend.loc="bottomright",

main="SP500 and US 10y Rate/Broad Dollar Index")

#dev.off() #jpeg(filename="correlation.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

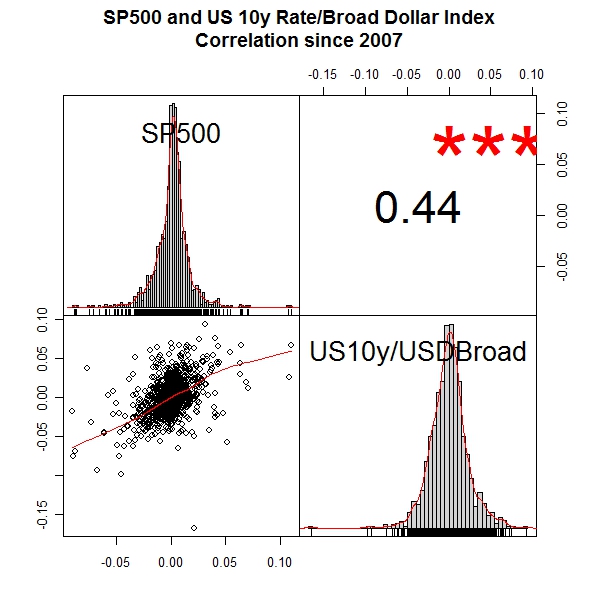

chart.Correlation(fedData["2007::"],

main="SP500 and US 10y Rate/Broad Dollar Index

Correlation since 2007")

#dev.off() #jpeg(filename="rolling correlation.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

chart.RollingCorrelation(fedData["2007::",1],fedData["2007::",2],n=250,

main="SP500 and US 10y Rate/Broad Dollar Index

Rolling 250 Day Correlation")

#dev.off() fedData <- na.omit(merge(SP500,DGS10,DTWEXM))

fedData <- merge(ROC(fedData[,1],type="discrete",n=1),

ROC(fedData[,2]/fedData[,3],type="discrete",n=1))

colnames(fedData) <- c("SP500","US10y/USDMajor") #jpeg(filename="performance.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

chart.CumReturns(fedData,legend.loc="topleft",

main="SP500 and US 10y Rate/Broad Dollar Index")

#dev.off() #jpeg(filename="correlation.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

chart.Correlation(fedData,

main="SP500 and US 10y Rate/Broad Dollar Index

Correlation Since 1973")

#dev.off() #jpeg(filename="rolling correlation.jpg",quality=100,

# width=6.25, height = 6.25, units="in",res=96)

chart.TimeSeries(runMean(runCor(fedData[,1],fedData[,2],n=250),n=250),

main="SP500 and US 10y Rate/Broad Dollar Index

Rolling 250 Day Average of Rolling 250 Day Correlation")

#dev.off()

Hi there,

ReplyDeleteThese scatter plots look to not be reflected by the regression line you've used.

Consider having a look at them when using a 0.5 quantile regression (you can use the rq function from the quntreg package), to see how different the results are.

Cheers,

Tal