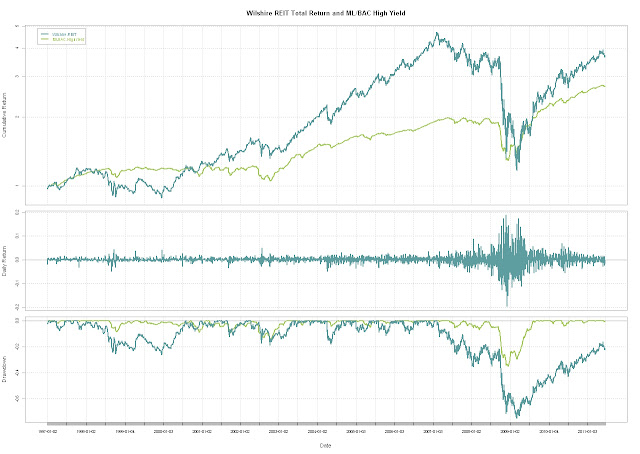

As a quick follow-up to my first REITs for Everybody Might Now Mean REITs for Nobody, I want to look at REITs and High Yield bonds, which also might simultaneously attract conservative yield buyers and speculative beta chasers.

HYG (iShares High Yield) and IYR (iShares REIT)

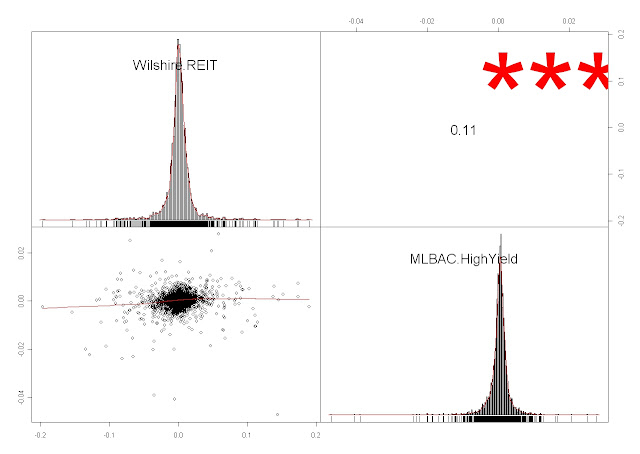

With R we can statistically analyze the similarity of REITs and High Yield.

R code (click to download):

#analyze REITs and High Yield require(quantmod)

require(PerformanceAnalytics) #get ML/BAC High Yield Index

MLHY <- getSymbols("BAMLHYH0A0HYM2TRIV",src="FRED",auto.assign=FALSE)

#get Wilshire REIT Index

getSymbols("WILLREITIND",src="FRED") prices <- na.omit(merge(WILLREITIND,MLHY))

colnames(prices) <- c("Wilshire.REIT","MLBAC.HighYield")

returns <- ROC(prices,n=1,type="discrete") charts.PerformanceSummary(returns,ylog=TRUE,

main="Wilshire REIT Total Return and ML/BAC High Yield",

colorset=c("cadetblue","darkolivegreen3")) chart.TimeSeries(runCor(returns[,1],returns[,2],n=250),

main="Wilshire REIT Total Return and ML/BAC High Yield

Rolling 1 Year Correlation",colorset="cadetblue") chart.Correlation(returns)

Created by Pretty R at inside-R.org

No comments:

Post a Comment