require(quantmod)

require(PerformanceAnalytics)

#get NAREIT data

#I like NAREIT since I get back to 1971

#much easier though to get Wilshire REIT from FRED

#also it is daily instead of monthly

#getSymbols("WILLREITIND",src="FRED") will do this

require(gdata)

reitURL <- "http://returns.reit.com/returns/MonthlyHistoricalReturns.xls"

reitExcel <- read.xls(reitURL,sheet="Data",pattern="All REITs",stringsAsFactors=FALSE)

#clean up dates so we can use xts functionality later

datetoformat <- reitExcel[,1]

datetoformat <- paste(substr(datetoformat,1,3),"-01-",substr(datetoformat,5,6),sep="")

datetoformat <- as.Date(datetoformat,format="%b-%d-%y")

reitExcel[,1] <- datetoformat

#############now start the yield analysis#####################

#get REIT yield

reitYield <- as.xts(as.numeric(reitExcel[4:NROW(reitExcel),7]),

order.by=reitExcel[4:NROW(reitExcel),1])

######get BAA and 10y from Fed to compare

getSymbols("BAA",src="FRED")

getSymbols("GS10",src="FRED")

######get SP500 yield from some multpl.com

##fantastic site with easily accessible historical information

spYield <- read.csv("http://www.multpl.com/s-p-500-dividend-yield/s-p-500-dividend-yield.csv")

spYield <- as.xts(spYield[,2],order.by=as.Date(spYield[,1]))

yieldCompare <- na.omit(merge(reitYield,spYield,BAA,GS10))

chart.TimeSeries(yieldCompare, legend.loc = "topleft",cex.legend=1.2,lwd=3,

main="Yield Comparison of REITs with S&P500, BAA Yield, and US 10y Yield",

colorset = c("cadetblue","darkolivegreen3","goldenrod","gray70"))

#get yield spread information

yieldSpread <- yieldCompare[,1:3]

yieldSpread[,1] <- yieldCompare[,1]-yieldCompare[,2]

yieldSpread[,2] <- yieldCompare[,1]-yieldCompare[,3]

yieldSpread[,3] <- yieldCompare[,1]-yieldCompare[,4]

colnames(yieldSpread) <- c("REIT Yield - S&P500 Yield",

"REIT Yield - BAA Yield","REIT Yield - US 10y Yield")

chart.TimeSeries(yieldSpread, legend.loc = "topleft",cex.legend=1.2,lwd=3,

main="Yield Spreads of REITs with S&P500, BAA Yield, and US 10y Yield",

colorset = c("cadetblue","darkolivegreen3","goldenrod"))

#############now start the return analysis###################

#shift colnames over 1

colnames(reitExcel) <- colnames(reitExcel)[c(1,1:(NCOL(reitExcel)-1))]

#get dates and return columns

reitData <- reitExcel[,c(3,24,38)]

#name columns

colnames(reitData) <- c(paste(colnames(reitExcel)[c(3,24,38)],".Total.Return",sep=""))

reitData <- reitData[3:NROW(reitData),]

#erase commas

col2cvt <- 1:NCOL(reitData)

reitData[,col2cvt] <- lapply(reitData[,col2cvt],function(x){as.numeric(gsub(",", "", x))})

#create xts

reitData <- as.xts(reitData,order.by=reitExcel[3:NROW(reitExcel),1])

#######get sp500 to compare beta and other measures

getSymbols("SP500",src="FRED")

SP500 <- to.monthly(SP500)[,4]

#get 1st of month to align when we merge

index(SP500) <- as.Date(index(SP500))

#merge REIT and S&p

returnCompare <- na.omit(merge(reitData,SP500))

returnCompare <- ROC(returnCompare,n=1,type="discrete")

charts.RollingRegression(returnCompare[, 1:3], returnCompare[,4],

width=36,lwd = 3,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Indexes Compared to the S&P 500

36 month Rolling",

colorset=c("cadetblue","darkolivegreen3","goldenrod"))

chart.RollingPerformance(returnCompare,

FUN="Return.annualized",width=36,lwd = 3,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Indexes Compared to the S&P 500

36 month Rolling Return",

colorset=c("cadetblue","darkolivegreen3","goldenrod","gray70"))

chart.RiskReturnScatter(returnCompare["1971::2003"],

lwd = 3,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Indexes Compared to the S&P 500 1971-2003",

colorset=c("cadetblue","darkolivegreen3","goldenrod","gray70"))

chart.RiskReturnScatter(returnCompare["2004::"],

lwd = 3,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Indexes Compared to the S&P 500 Since 2004",

colorset=c("cadetblue","darkolivegreen3","goldenrod","gray70"))

charts.PerformanceSummary(returnCompare,ylog=TRUE,

lwd = 3,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Indexes Compared to the S&P 500",

colorset=c("cadetblue","darkolivegreen3","goldenrod","gray70"))

#############now start the bucket analysis###################

#bucket momentum as described by Aleph Blog

#get 10 month moving average

#set up avg with same as reitData

avg <- reitData[,1:3]

avg <- as.data.frame(avg)

avg[,1:3] <- lapply(reitData[,1:3],runMean,n=10)

avg <- as.xts(avg)

#get % above 10 month moving average

momscore <- reitData/avg-1

#break into 5 evenly distributed by frequency quintiles

#get signal into 3 column xts

signal <- momscore

for(i in 1:3) {

breaks <- quantile(momscore[,i], probs = seq(0, 1, 0.20),na.rm=TRUE)

#use default labels=TRUE to see how this works

buckets <- cut(momscore[,i], include.lowest=TRUE, breaks=breaks)

#store so we can see later

ifelse(i==1,bucket_ranges <- names(table(buckets)),

bucket_ranges <- rbind(bucket_ranges,names(table(buckets))))

#now use labels=FALSE to return 1-5 based on quintile

buckets <- cut(momscore[,i], breaks=breaks, labels=FALSE)

signal[,i] <- as.xts(buckets,order.by=index(signal))

#move forward by 1

}

#name bucket_ranges with reit column names

rownames(bucket_ranges)<-colnames(reitData)

signal <- lag(signal,k=1)

ret <- signal

#showing my R weakness here and had to go back to for..next

for(i in 1:3) {

ret[,i] <- ifelse(signal[,i] >= 3,1,0) * ROC(reitData[,1],1,type="discrete")

}

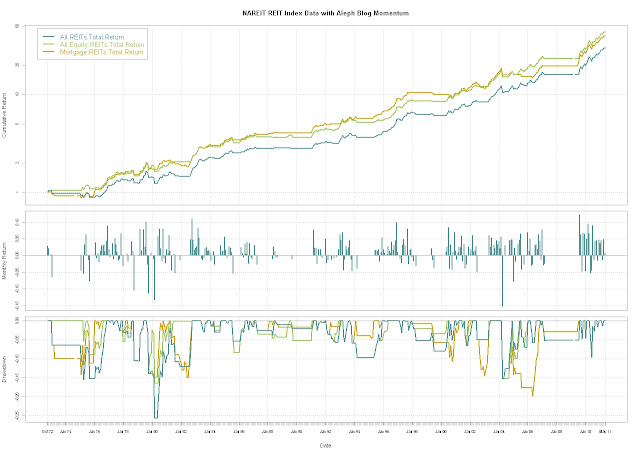

charts.PerformanceSummary(ret,ylog=TRUE,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Index Data with Aleph Blog Momentum",

colorset=c("cadetblue","darkolivegreen3","goldenrod"))

getSymbols("DJIA",src="FRED")

#examine DJIA quantiles prior to 1973 to see if we could

#know in advance what possible REIT quantiles would work

DJIA <- to.monthly(DJIA)["1896::1971",4]

momDJIA <- DJIA/runMean(DJIA,n=10)-1

breaks <- quantile(momDJIA, probs = seq(0, 1, 0.20),na.rm=TRUE)

buckets <- cut(momDJIA, breaks=breaks)

table(buckets) #what happens if we apply the DJIA prior to 1973 buckets to the REITs

ret <- merge(ret,ret)

for(i in 1:3) {

#if REITs > 3.95% above 10 month moving average then long

#3.95% is the lower end of the DJIA 1896-1971 3 momentum quantile

ret[,i+3] <- lag(ifelse(momscore[,i] >= 0.0395,1,0),1) * ROC(reitData[,1],1,type="discrete")

}

colnames(ret)[4:6]<-paste(colnames(reitData[,1:3])," with DJIA buckets",sep="")

#much much better than I expected

charts.PerformanceSummary(ret,ylog=TRUE,legend.loc = "topleft",cex.legend=1.2,

main="NAREIT REIT Index Data with Aleph Blog Momentum but DJIA Momentum Buckets",

colorset=c("cadetblue","darkolivegreen3","goldenrod",

"coral","darkorchid","darkolivegreen"))

Subject to all the caveats of my own revised analysis, this is fine. Momentum is pervasive in the markets, with valuation second.

ReplyDeleteHello, wondering if you could explain this idea to me a bit better as I am having trouble interpreting the code and can't comment on the Aleph Blog link.

ReplyDelete"So I constructed a rule to be invested in REITs if they were in the third momentum quintile or higher, or be invested in one year Treasuries otherwise."

So you take the universe of REITS, sort into quintiles by their momentum (as defined by % above 10 month SMA) and only invest in those REITS which are in the third quintile or higher?

Except it looks like your equity curve is more like

"only invest in those REITS which are in the third quintile or higher AND > 10 month SMA".

Am I right?

Glad you are reading. This system is only built at the index level, and there is no analysis of the components. If the index is in its 40% or better performance quintile as measured by price above the 10 month moving average, then own it and otherwise exit. So, your line should be only invest in the REIT index if its price is greater than the 10 month moving SMA by an amount that is historically in the 40-100% of the distribution.

ReplyDeleteAh ok, that's what I originally thought! But then I didn't understand the "historical" bit, is the historical window rolling? Or cumulative since the start of the time-series?

ReplyDeleteI see on some quant blogs they use PercentRank function, but usually they apply a 1 year rolling window. e.g.

PercentRank(SMA(10,MonthClose),12) > 0.6

So I guess in your case you are saying

PercentRank(SMA(10,MonthClose),N) > 0.6 where N is the length of the time-series in months?

Appreciate the response. Love your blog, only found it a few days ago. I noticed you use the utility spread in a post combined with the turbulence thingy, I've done research into the same concept. There are two new ETFs, "SPLV" and "SPHB", I think you will find they provide a better defensive spread.

This is not really a tradeable system since it incorporates hindsight bias using the entire history deciding where to trade. The last bit takes the historical level of 3.95% above the 10 month moving average and backtests this on the DJIA. If you were to use this going forward, it would mean you own the REIT index any time it is more than 3.95% above its 10 month moving average.

DeleteYou might find http://timelyportfolio.blogspot.com/2011/05/s-500-high-beta-and-low-volatility.html interesting.

Right, understood and thanks for the clarification!

DeleteYou might find this interesting as a method to adapt the above concept to be tradeable then,

http://cssanalytics.wordpress.com/2010/05/19/percentrank-sma/

Haha I see you beat me to it on the LV/HB, nice one.

errr, apologies for that pseudocode it should be more like

ReplyDeletePercentRank(MonthClose/SMA(10,MonthClose),N) > 0.6