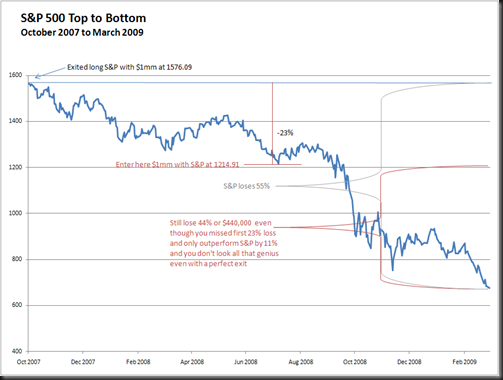

Compounding negative returns is not as splendid as Albert Einstein’s (if he said it at all) “most powerful force in the universe” of compounding interest or positive returns. Drawdown is a series of traps or a compounding of really ugly negative returns. Let’s say that you as master investor exited your $1,000,000 million position in the S&P 500 at the exact top in October 2007 at 1576.09. You wait very patiently and based on your investment experience from 1980-2006, reenter at 1214.91 down 23% seven months later as discussed in in Barron's July 2008. The money you don’t lose or save is not 55% (total loss to S&P) – the 23% you missed. Rather, it is still a very painful loss of 44% and it does not seem so genius even with a genius exit. This trap hurt a lot of supposed geniuses that earned that reputation from 1980-2006.

1 hour

No comments:

Post a Comment