I struggled with whether or not I should even post this. It is raw and ugly, but it might help somebody out there. I might use this as a basis for some more gridSVG posts, but I do not think I have the motivation to finish the analysis.

Code:

require(latticeExtra)

require(quantmod)

require(PerformanceAnalytics)

getSymbols("SP500",src="FRED")

US10 <- na.omit(getSymbols("DGS10",src="FRED",auto.assign=FALSE))

stocksBonds <- na.omit(

merge(

lag(SP500,k=-100)/SP500-1, #forward 100 day sp500 perf

US10 / runMean(US10,n=250) - 1, #us10 yield - 250 day average

SP500

)

)

#get the decade

stocksBonds$decade = as.numeric(substr(index(stocksBonds),1,3)) * 10

#name columns

colnames(stocksBonds) <- c("sp500","us10","SP500","decade")

#get a color ramp for our change in us10 year yields

linecolors <- colorRamp(

c("red","green"),

interpolate="linear",

space="rgb"

)((stocksBonds[,2]+0.5))

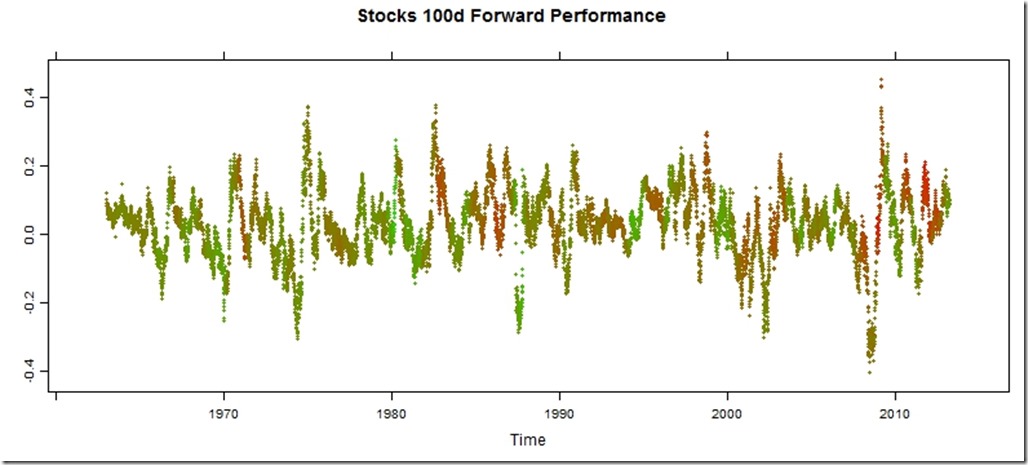

xyplot(

stocksBonds[,1],

col=rgb(linecolors,max=255),

type="p",pch=19,cex=0.5,

main = "Stocks 100d Forward Performance"

)

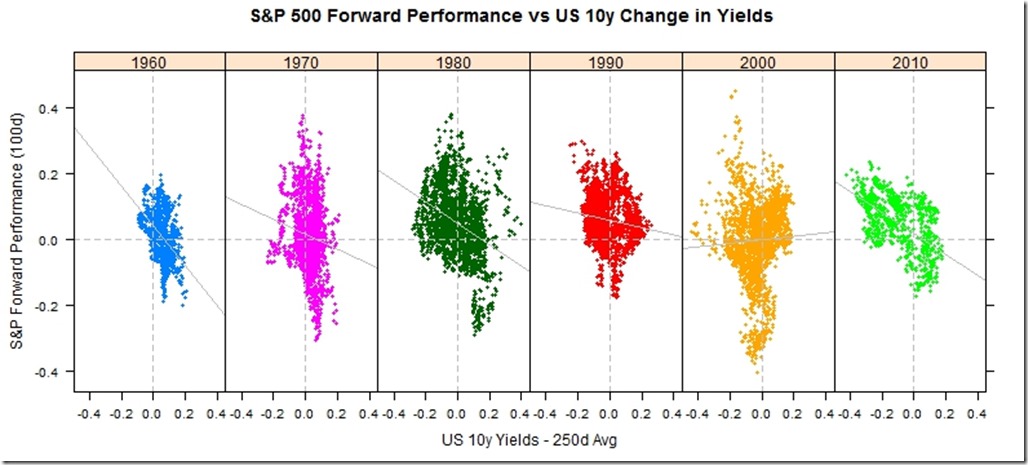

xyplot(

sp500 ~ us10 | factor(decade),

groups = decade,

data = as.data.frame(stocksBonds),

pch=19,

cex = 0.5,

scales = list(

x = list(tck=c(1,0),alternating=1)

),

layout=c(6,1),

main = "S&P 500 Forward Performance vs US 10y Change in Yields",

ylab = "S&P Forward Performance (100d)",

xlab = "US 10y Yields - 250d Avg"

) +

latticeExtra::layer(panel.abline(h=0,col="gray",lty=2)) +

latticeExtra::layer(panel.abline(v=0,col="gray",lty=2)) +

xyplot(

sp500 ~ us10 | factor(decade),

col="gray",

data = as.data.frame(stocksBonds),

panel = panel.lmline)

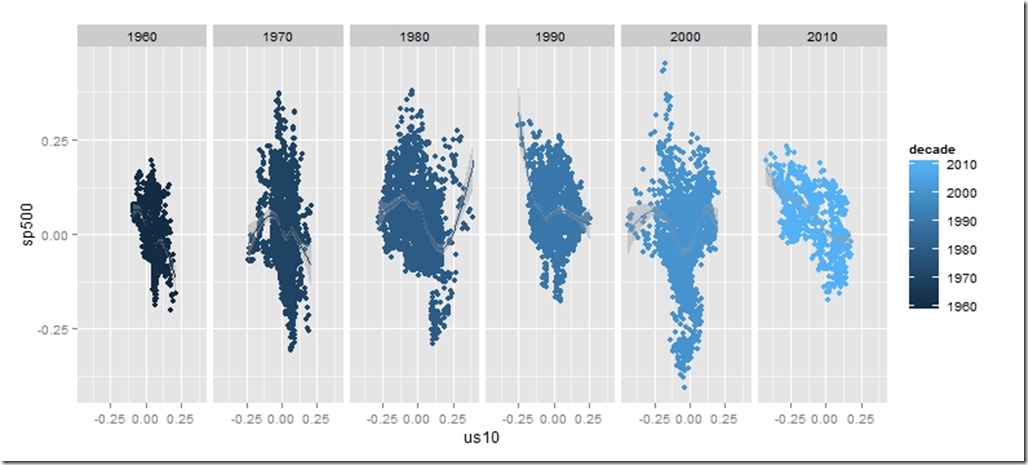

require(ggplot2)

ggplot(data = data.frame(stocksBonds), aes(y=sp500, x= us10,colour=decade))+

geom_point()+facet_wrap(~decade,ncol=6)+geom_smooth()

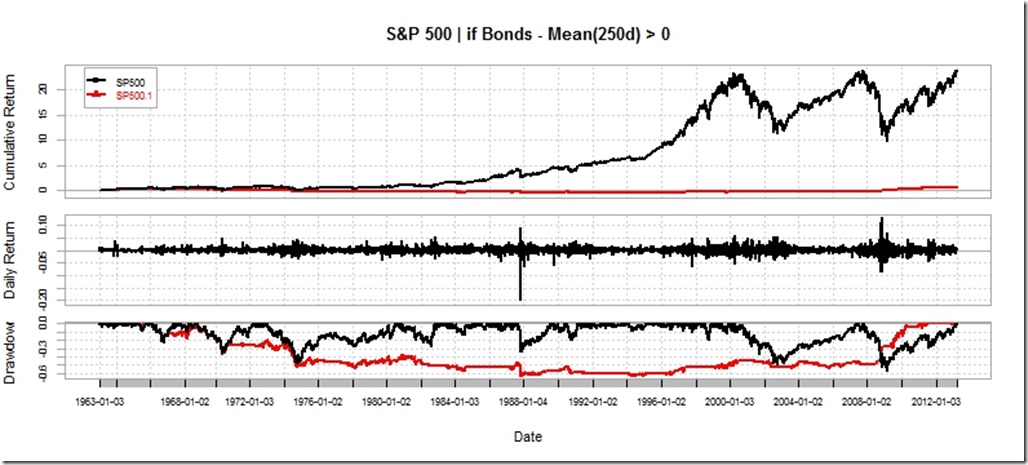

charts.PerformanceSummary(

merge(

ROC(stocksBonds[,3],n=1,type="discrete"),

ROC(stocksBonds[,3],n=1,type="discrete") * (stocksBonds[,2]>0)

),

main="S&P 500 | if Bonds - Mean(250d) > 0"

)

Nice post. It may be more interesting though to look at the 10Y-3M spread against the forward S&P return.

ReplyDelete