Long EEM Short IWM potentially works in 3 ways:

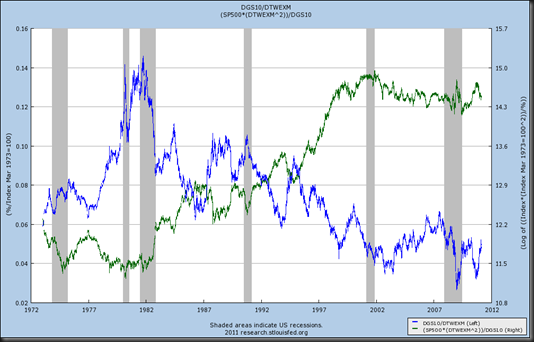

1) See my last post “Asian Currency Opportunity” where currency undervaluation means potential gain of 20-50% versus the US$ and 50%-100% versus the Japanese Yen. However, even absent the undervaluation, the spread offers protection against a declining dollar, for which most US bond, equity, and real estate investors are not well enough hedged.

2) If the currency undervaluation is not enough, EEM offers better growth at a far lower valuation on an equity basis. These are not the best indicators of value, but they are public, so I can share them here

Emerging and US Small Cap valuation from Vanguard

| Equity characteristics as of 02/28/2011 | ||||

| Emerging Mkts Stk Idx Inv | MSCI Emerging Markets Index Net USD | Small-Cap Index Fund Inv | MSCI US Small Cap 1750 Index | |

| Number of stocks | 900 | 796 | 1722 | 1716 |

| Median market cap | $18.6 billion | $18.9 billion | $1.8 billion | $1.8 billion |

| price/earnings ratio | 14.5x | 14.3x | 26.1x | 26.1x |

| price/book ratio | 2.2x | 2.1x | 2.1x | 2.1x |

| return on equity | 21.70% | 21.00% | 10.20% | 10.20% |

| earnings growth rate | 14.30% | 13.70% | 3.80% | 4.00% |

Emerging and US Small Cap valuation stats from iShares EEM and iShares IWM

| Fundamentals & Risk as of 2/28/2011 | ||

| EEM | IWM | |

| 12-Month Yield | 1.41% | 1.09% |

| Price to Earnings Ratio | 18.69 | 27.98 |

| Price to Book Ratio | 3.44 | 3.58 |

3) The spread offers low correlation versus stocks and bonds in a persistently and dangerously high correlation environment.

|

| From TimelyPortfolio |

|

| From TimelyPortfolio |

I’m still not exactly sure how this is calculated, but I thought this offered another look at something statistical, and I feel is not very well covered by other examples. Points closest to each other on the chart are most related.

|

| From TimelyPortfolio |

R code:

require(quantmod)

require(PerformanceAnalytics)

require(fAssets)

tckr<-c("EEM","IEF","IWM","GLD","SPY")

start<-"2005-01-01"

end<- format(Sys.Date(),"%Y-%m-%d") # yyyy-mm-dd

# Pull tckr index data from Yahoo! Finance

getSymbols(tckr, from=start, to=end)

EEM<-adjustOHLC(EEM,use.Adjusted=T)

IEF<-adjustOHLC(IEF,use.Adjusted=T)

IWM<-adjustOHLC(IWM,use.Adjusted=T)

GLD<-adjustOHLC(GLD,use.Adjusted=T)

SPY<-adjustOHLC(SPY,use.Adjusted=T)

EEM<-to.weekly(EEM, indexAt='endof')

IEF<-to.weekly(IEF, indexAt='endof')

IWM<-to.weekly(IWM, indexAt='endof')

GLD<-to.weekly(GLD, indexAt='endof')

SPY<-to.weekly(SPY, indexAt='endof')

EEMIWM<-to.weekly(EEM/IWM, indexAt='endof')

RetToAnalyze<-merge(weeklyReturn(EEM),weeklyReturn(IEF),weeklyReturn(IWM),weeklyReturn(GLD),weeklyReturn(SPY),weeklyReturn(EEMIWM))

colnames(RetToAnalyze)<-c(tckr,"EEMIWM")

assetsDendrogramPlot(as.timeSeries(RetToAnalyze))

assetsCorEigenPlot(as.timeSeries(RetToAnalyze))

mtext("Source: Yahoo! Finance",side=1,adj=0)

chart.Correlation(RetToAnalyze[,1:6,drop=F], main="Correlation since 2005")

mtext("Source: Yahoo! Finance",side=1,adj=0)

#get Rolling Correlations with IEF(bonds) and SPY(stocks)

corEEMIWMtoBonds<-runCor(RetToAnalyze[,6],RetToAnalyze[,2],25)

corEEMIWMtoStocks<-runCor(RetToAnalyze[,6],RetToAnalyze[,5],25)

chartSeries(EEMIWM,TA="addBBands();addTA(corEEMIWMtoBonds);addTA(corEEMIWMtoStocks)",theme="white")

mtext("Source: Yahoo! Finance",side=1,adj=0)

Disclosure: AS ALWAYS, THESE ARE MY OPINIONS AND THE FUTURE IS UNPREDICTABLE. CONDITIONS CHANGE AND I ADJUST POTENTIALLY WITHOUT DISCLOSURE ON THIS BLOG. YOU ARE ON YOUR OWN MAKING INVESTMENT DECISIONS, AND IN NO WAY AM I ADVISING YOU. I TAKE NO RESPONSIBILITY FOR YOUR GAINS OR LOSSES.