I first wanted to thank

http://www.fosstrading.com for the very kind and unexpected mention over the weekend. You will notice almost all of my code contains some credit to Foss Trading for the examples and great packages. I hate that I could not join everyone at

R/Finance 2011: Applied Finance with R Conference last weekend.

In my last post

Another Use of LSPM in Tactical Portfolio Allocation, I expressed a slight bit of frustration with the drawdown experienced with the final system. Since I got no comments or feedback on improvements, I guess I will have to try to answer my own question, “How do I reduce the drawdown?” My first thought was to use the techniques shown in my previous set of posts

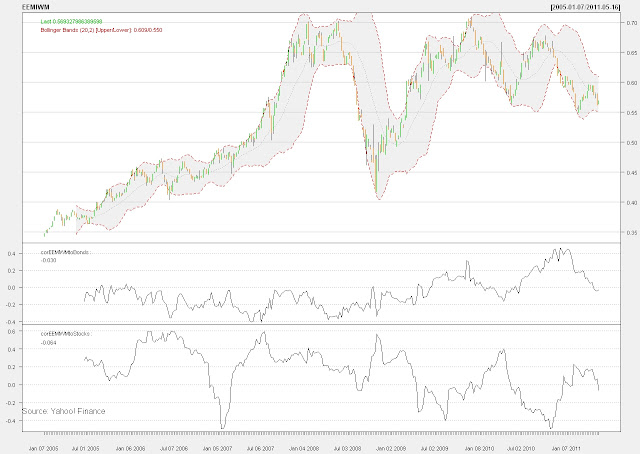

Great FAJ Article on Statistical Measure of Financial Turbulence Part 3 about

Mahalanobis distance as a measure of financial turbulence.

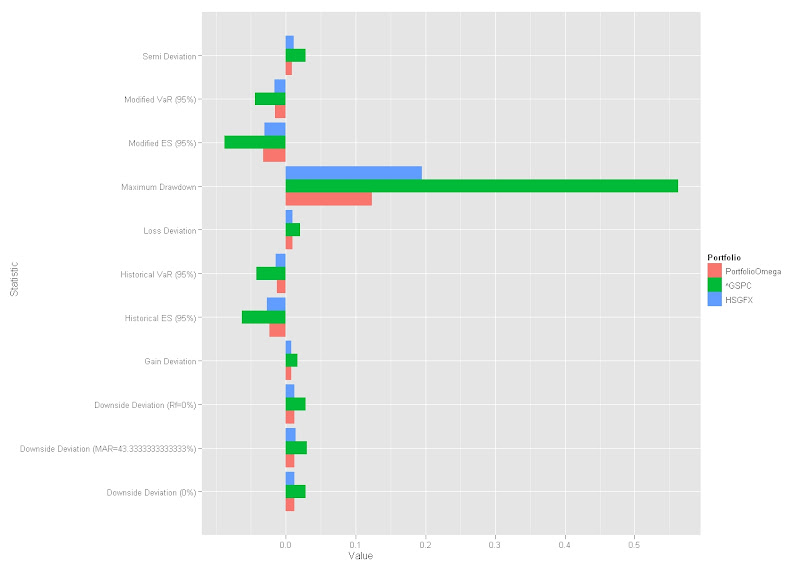

The results demonstrate a slight improvement in max drawdown and other downside measures, but does not ultimately satisfy my constant yearning for smaller drawdown.

If nothing else, maybe you can use my ggplot2 chart of a PerformanceAnalytics table. I was pretty excited to get this working, and I plan to incorporate many more of these in my testing.

|

| From TimelyPortfolio |

I blog to record my thoughts and hopefully generate a valuable dialogue with my readers who are probably far smarter and more qualified than me. Please comment or provide feedback.

R code:

#Please see au.tra.sy blog

http://www.automated-trading-system.com/

#for original walkforward/optimize code and

http://www.fosstrading.com

#for other techniques

require(PerformanceAnalytics)

require(quantmod)

require(RQuantLib)

require(reshape2) #for some fancy ggplot charting

require(ggplot2)

#get bond returns to avoid proprietary data problems

#see previous timelyportfolio blogposts for explanation

#probably need to make this a function since I will be using so much

getSymbols("GS10",src="FRED") #load US Treasury 10y from Fed Fred

GS10pricereturn<-GS10 #set this up to hold price returns

GS10pricereturn[1,1]<-0

colnames(GS10pricereturn)<-"PriceReturn"

#I know I need to vectorize this but not qualified enough yet

#Please feel free to comment to show me how to do this

for (i in 1:(NROW(GS10)-1)) {

GS10pricereturn[i+1,1]<-FixedRateBondPriceByYield(yield=GS10[i+1,1]/100,issueDate=Sys.Date(),

maturityDate= advance("UnitedStates/GovernmentBond", Sys.Date(), 10, 3),

rates=GS10[i,1]/100,period=2)[1]/100-1

}

#interest return will be yield/12 for one month

GS10interestreturn<-lag(GS10,k=1)/12/100

colnames(GS10interestreturn)<-"Interest Return"

#total return will be the price return + interest return

GS10totalreturn<-GS10pricereturn+GS10interestreturn

colnames(GS10totalreturn)<-"Bond Total Return"

#get sp500 returns from FRED

getSymbols("SP500",src="FRED") #load SP500

#unfortunately cannot get substitute for proprietary CRB data

#get data series from csv file

CRB<-as.xts(read.csv("spxcrbndrbond.csv",row.names=1))[,2]

#do a little manipulation to get the data lined up on monthly basis

GS10totalreturn<-to.monthly(GS10totalreturn)[,4]

SP500<-to.monthly(SP500)[,4]

#get monthly format to yyyy-mm-dd with the first day of the month

index(SP500)<-as.Date(index(SP500))

#my CRB data is end of month; could change but more fun to do in R

CRB<-to.monthly(CRB)[,4]

index(CRB)<-as.Date(index(CRB))

#now lets merge to get asset class returns

assetROC<-na.omit(merge(ROC(SP500,type="discrete"),CRB,GS10totalreturn))

# Set Walk-Forward parameters (number of periods)

optim<-12 #1 year = 12 monthly returns

wf<-1 #walk forward 1 monthly returns

numsys<-2

# Calculate number of WF cycles

numCycles = floor((nrow(assetROC)-optim)/wf)

# Define JPT function

# this is now part of LSPM package, but fails when no negative returns

# so I still include this where I can force a negative return

jointProbTable <- function(x, n=3, FUN=median, ...) {

# Load LSPM

if(!require(LSPM,quietly=TRUE)) stop(warnings())

# handle case with no negative returns

for (sys in 1:numsys) {

if (min(x[,sys])> -1) x[,sys][which.min(x[,sys])]<- -0.03

}

# Function to bin data

quantize <- function(x, n, FUN=median, ...) {

if(is.character(FUN)) FUN <- get(FUN)

bins <- cut(x, n, labels=FALSE)

res <- sapply(1:NROW(x), function(i) FUN(x[bins==bins[i]], ...))

}

# Allow for different values of 'n' for each system in 'x'

if(NROW(n)==1) {

n <- rep(n,NCOL(x))

} else

if(NROW(n)!=NCOL(x)) stop("invalid 'n'")

# Bin data in 'x'

qd <- sapply(1:NCOL(x), function(i) quantize(x[,i],n=n[i],FUN=FUN,...))

# Aggregate probabilities

probs <- rep(1/NROW(x),NROW(x))

res <- aggregate(probs, by=lapply(1:NCOL(qd), function(i) qd[,i]), sum)

# Clean up output, return lsp object

colnames(res) <- colnames(x)

res <- lsp(res[,1:NCOL(x)],res[,NCOL(res)])

return(res)

}

for (i in 0:(numCycles-1)) {

# Define cycle boundaries

start<-1+(i*wf)

end<-optim+(i*wf)

# Get returns for optimization cycle and create the JPT

# specify number of bins; does not seem to drastically affect results

numbins<-6

jpt <- jointProbTable(assetROC[start:end,1:numsys],n=rep(numbins,numsys))

outcomes<-jpt[[1]]

probs<-jpt[[2]]

port<-lsp(outcomes,probs)

# DEoptim parameters (see ?DEoptim)

np=numsys*10 # 10 * number of mktsys

imax=1000 #maximum number of iterations

crossover=0.6 #probability of crossover

NR <- NROW(port$f)

DEctrl <- list(NP=np, itermax=imax, CR=crossover, trace=TRUE)

# Optimize f

res <- optimalf(port, control=DEctrl)

# use upper to restrict to a level that you might feel comfortable

#res <- optimalf(port, control=DEctrl, lower=rep(0,13), upper=rep(0.2,13))

# these are other possibilities but I gave up after 24 hours

#maxProbProfit from Foss Trading

#res<-maxProbProfit(port, 1e-6, 6, probDrawdown, 0.1, DD=0.2, control=DEctrl)

#probDrawdown from Foss Trading

#res<-optimalf(port,probDrawdown,0.1,DD=0.2,horizon=6,control=DEctrl)

# Save leverage amounts as optimal f

# Examples in the book Ralph Vince Leverage Space Trading Model

# all in dollar terms which confuses me

# until I resolve I changed lev line to show optimal f output

lev<-res$f[1:numsys]

#lev<-c(res$f[1]/(-jpt$maxLoss[1]/10),res$f[2]/(-jpt$maxLoss[2]/10))

levmat<-c(rep(1,wf)) %o% lev #so that we can multiply with the wfassetROC

# Get the returns for the next Walk-Forward period

wfassetROC <- assetROC[(end+1):(end+wf),1:numsys]

wflevassetROC <- wfassetROC*levmat #apply leverage to the returns

if (i==0) fullassetROC<-wflevassetROC else fullassetROC<-rbind(fullassetROC,wflevassetROC)

if (i==0) levered<-levmat else levered<-rbind(levered,levmat)

}

#not super familiar with xts, but this add dates to levered

levered<-xts(levered,order.by=index(fullassetROC) )

colnames(levered)<-c("sp500 optimal f","crb optimal f")

chart.TimeSeries(levered, legend.loc="topleft", cex.legend=0.6)

#review the optimal f values

#I had to fill the window to my screen to avoid a error from R on margins

par(mfrow=c(numsys,1))

for (i in 1:numsys) {

chart.TimeSeries(levered[,i],xlab=NULL)

}

#charts.PerformanceSummary(fullassetROC, ylog=TRUE, main="Performance Summary with Optimal f Applied as Allocation")

assetROCAnalyze<-merge(assetROC,fullassetROC)

colnames(assetROCAnalyze)<-c("sp500","crb","US10y","sp500 f","crb f")

charts.PerformanceSummary(assetROCAnalyze,ylog=TRUE,main="Performance Summary with Optimal f Applied as Allocation")

#build a portfolio with sp500 and crb

leveredadjust<-levered

#allow up to 50% allocation in CRB

leveredadjust[,2]<-ifelse(levered[,2]<0.25,0,0.5)

#allow up to 100% allocation in SP500 but portfolio constrained to 1 leverage

leveredadjust[,1]<-ifelse(levered[,1]<0.25,0,1-levered[,2])

colnames(leveredadjust)<-c("sp500 portfolio allocation","crb portfolio allocation")

assetROCadjust<-merge(assetROCAnalyze,leveredadjust[,1:2]*assetROC[,1:2])

colnames(assetROCadjust)<-c("sp500","crb","US10y","sp500 f","crb f","sp500 system component","crb system component")

charts.PerformanceSummary(assetROCadjust,ylog=TRUE)

#review the allocations versus optimal f

#I had to fill the window to my screen to avoid a error from R on margins

par(mfrow=c(numsys,1))

for (i in 1:numsys) {

chart.TimeSeries(merge(levered[,i],leveredadjust[,i]),xlab=NULL,legend.loc="topleft",main="")

}

#add bonds when out of sp500 or crb

assetROCportfolio<-assetROCadjust[,6]+assetROCadjust[,7]+ifelse(leveredadjust[,1]+leveredadjust[,2] >= 1,0,(1-leveredadjust[,1]-leveredadjust[,2])*assetROC[,3])

assetROCadjust<-merge(assetROCAnalyze,assetROCportfolio)

colnames(assetROCadjust)<-c("sp500","crb","US10y","sp500 f","crb f","system portfolio")

charts.PerformanceSummary(assetROCadjust[,c(1:3,6)],ylog=TRUE,main="Optimal f System Portfolio with Bond Filler")

#see timelyportfolio blog post

http://timelyportfolio.blogspot.com/2011/04/great-faj-article-on-statistical_6197.html

#get Correlations for Mahalanobis filter

#get data from St. Louis Federal Reserve (FRED) to add 20y USTreasury data

getSymbols("GS20",src="FRED") #load 20yTreasury; 20y has gap 86-93; 30y has gap in early 2000s

getSymbols("GS30",src="FRED") #load 30yTreasury to fill 20y gap 86-93

#fill 20y gap from discontinued 20y Treasuries with 30y

GS20["1987-01::1993-09"]<-GS30["1987-01::1993-09"]

assetROC<-merge(assetROC,momentum(GS20)/100)

corrBondsSp<-runCor(assetROC[,4],assetROC[,1],n=7)

corrBondsCrb<-runCor(assetROC[,4],assetROC[,2],n=7)

corrSpCrb<-runCor(assetROC[,2],assetROC[,1],n=7)

#composite measure of correlations between asset classes and roc-weighted correlations

assetCorr<-(corrBondsSp+corrBondsCrb+corrSpCrb+

(corrBondsSp*corrSpCrb*assetROC[,1])+

(corrBondsCrb*corrSpCrb*assetROC[,2])-

assetROC[,4])/6

#sum of ROCs of asset classes

assetROCSum<-assetROC[,1]+assetROC[,2]+assetROC[,4]

#finally the turbulence measure

turbulence<-abs(assetCorr*assetROCSum*100)

colnames(turbulence)<-"Turbulence-correlation"

signal<-ifelse(turbulence>0.8,0,1)

signal<-lag(signal,k=1)

signal[0]<-0

system_perf_turbulence<-assetROCportfolio*signal

perf_compare<-merge(assetROC[,1:2],assetROCportfolio,system_perf_turbulence)

colnames(perf_compare)<-c("SP500","CRB","LSPMportfolio","LSPMportfolio_turbulence")

charts.PerformanceSummary(perf_compare,ylog=TRUE,colorset=c("gray70","goldenrod","cadetblue","darkolivegreen3"),main="Comparison of Original LSPM System and Turbulence LSPM System")

downsideTable<-melt(cbind(rownames(table.DownsideRisk(perf_compare)),table.DownsideRisk(perf_compare)))

colnames(downsideTable)<-c("Statistic","Portfolio","Value")

ggplot(downsideTable, stat="identity", aes(x=Statistic,y=Value,fill=Portfolio)) + geom_bar(position="dodge") + coord_flip()